IRS Announces Retirement Plan Limitations for 2020

November 6, 2019

Earlier today the Internal Revenue Service issued Notice 2019-59 announcing the cost-of-living adjustments applicable to pension and retirement plan dollar limitations for tax year 2020. The elective deferral limit for participants who participate in 401(k), 403(b), 457(b) plans and SARSEPs has increased $500, from $19,000 in 2019 to $19,500 in 2020. Likewise, the $6,000 catch-up contribution limit (for participants age 50 and over) has increased from $6,000 to $6,500. A change in a limitation means that the increase in the cost-of-living was sufficient to trigger the applicable statutory Cost-of-Living Adjustment (“COLA”).

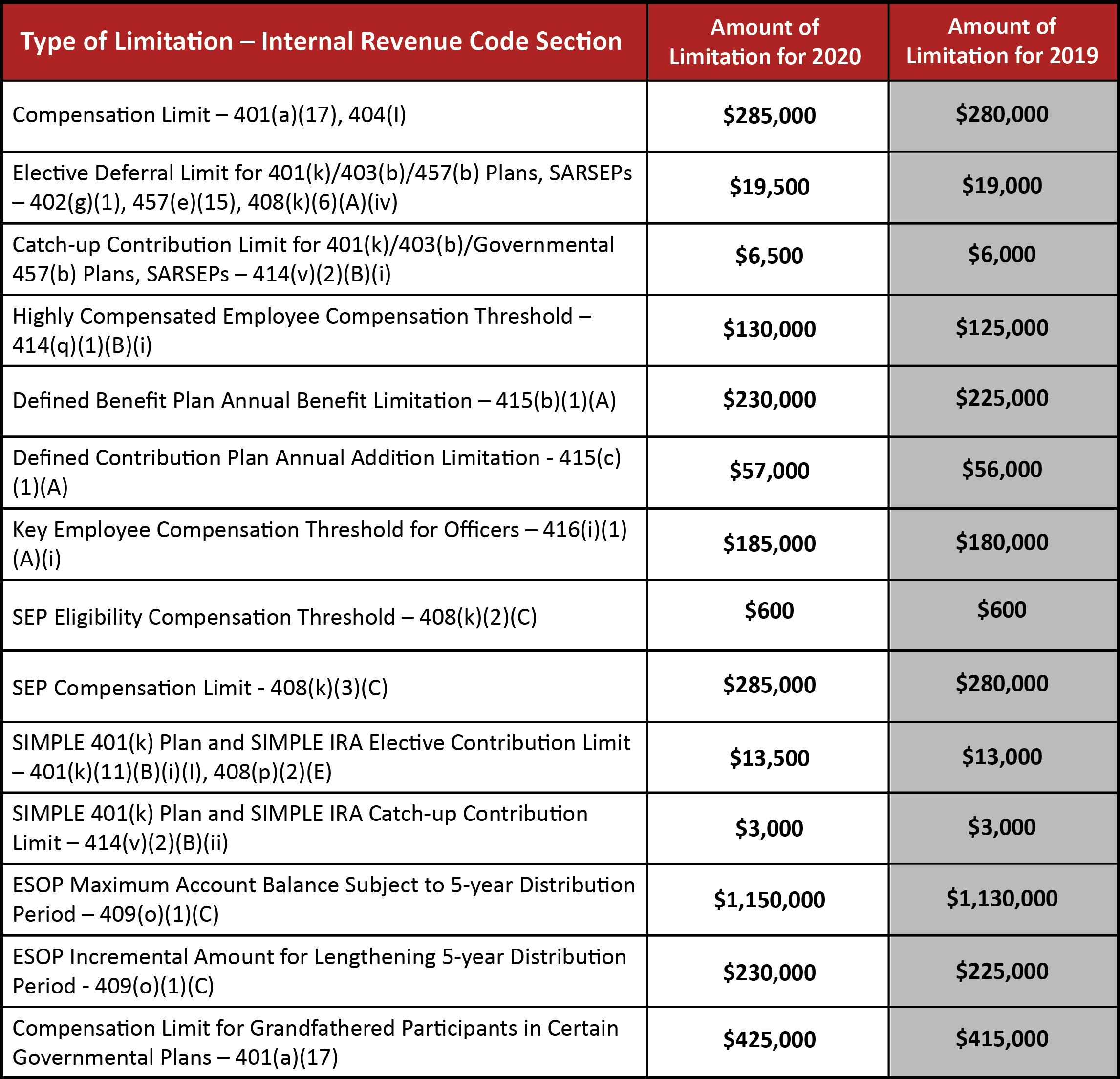

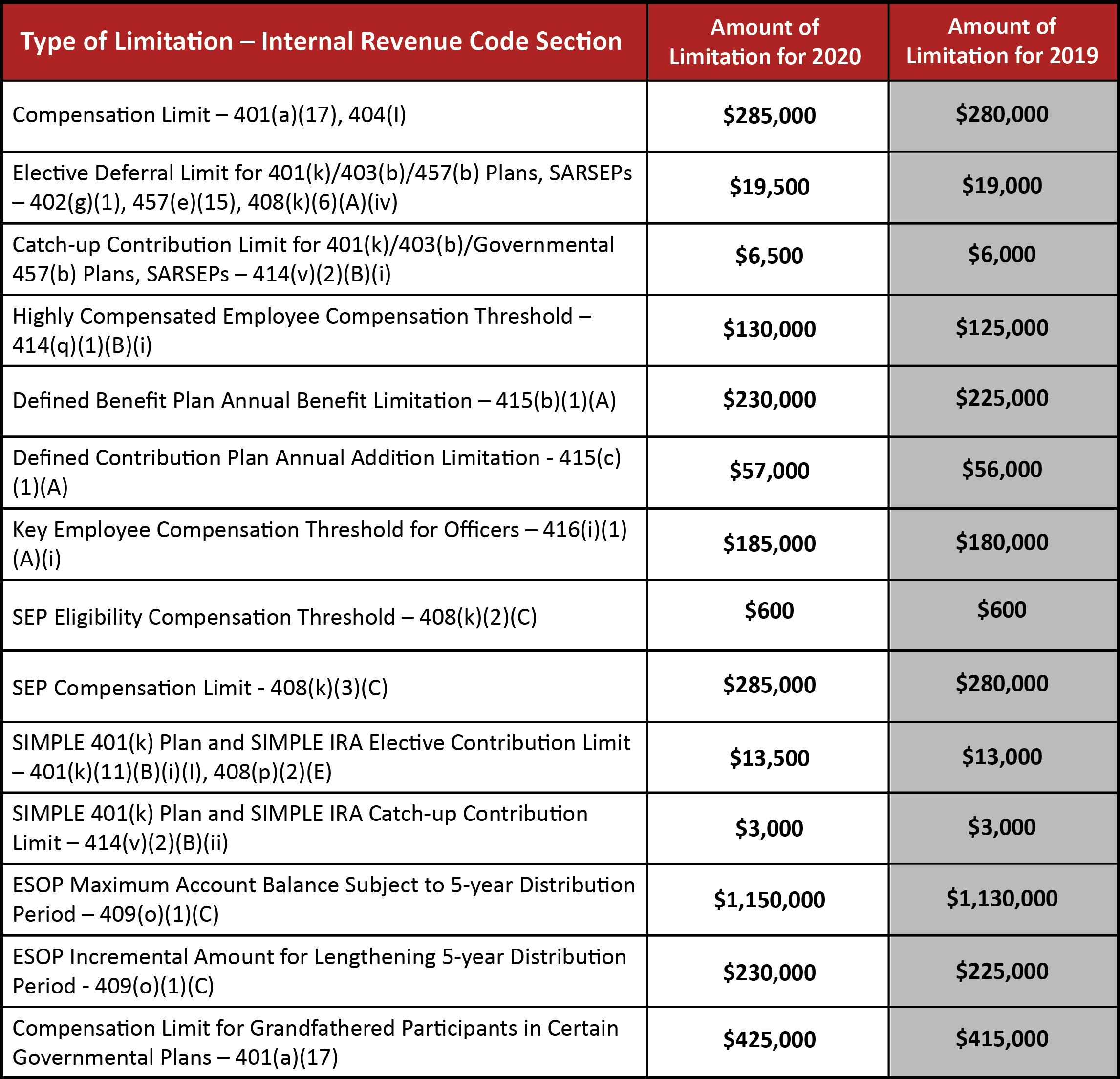

The following table summarizes many of the retirement plan limitations for the 2019 and 2020 tax years, all of which have increased for 2020, except for the SEP Eligibility Compensation Threshold and the SIMPLE 401(k) Plan and SIMPLE IRA Catch-up Contribution limit, which remain the same as last year. Additionally, on October 10, 2019, the Social Security Administration determined that the 2020 social security wage base will increase to $137,700 for 2020, up from $132,900 in 2019.

For further information regarding the 2020 retirement plan limitations or to discuss any other retirement or welfare plan matters, please contact any member of our Employee Benefits and Executive Compensation Practice Group.

November 6, 2019

Earlier today the Internal Revenue Service issued Notice 2019-59 announcing the cost-of-living adjustments applicable to pension and retirement plan dollar limitations for tax year 2020. The elective deferral limit for participants who participate in 401(k), 403(b), 457(b) plans and SARSEPs has increased $500, from $19,000 in 2019 to $19,500 in 2020. Likewise, the $6,000 catch-up contribution limit (for participants age 50 and over) has increased from $6,000 to $6,500. A change in a limitation means that the increase in the cost-of-living was sufficient to trigger the applicable statutory Cost-of-Living Adjustment (“COLA”).

The following table summarizes many of the retirement plan limitations for the 2019 and 2020 tax years, all of which have increased for 2020, except for the SEP Eligibility Compensation Threshold and the SIMPLE 401(k) Plan and SIMPLE IRA Catch-up Contribution limit, which remain the same as last year. Additionally, on October 10, 2019, the Social Security Administration determined that the 2020 social security wage base will increase to $137,700 for 2020, up from $132,900 in 2019.

For further information regarding the 2020 retirement plan limitations or to discuss any other retirement or welfare plan matters, please contact any member of our Employee Benefits and Executive Compensation Practice Group.